jersey city property tax rate 2020

The average of assessed home values in the county for 2021 was 312831. The current total local sales tax rate in Jersey City NJ is 6625.

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

Studying in Australia immigration consultants in Chandigarh.

. We had placed a call to the property tax administrator who had provided the updated rate of 161. Homeowners in New Jersey pay the highest property taxes of any state in the country. Chris Christie put into effect in 2011.

The average effective property tax rate in New Jersey is 242 compared with a national average of 107. The Jersey City sales tax rate is. Portions of Jersey City are part of the Urban Enterprise Zone.

This is the total of state county and city sales tax rates. Property Tax Rate per 100 2019-2020 2020-2021 Difference Debt Service 0136379 0132072 -004307 Operations Maintenance 0606121 0591394 -014727 TOTAL 074250 0723466. ARP aid expires in 2024.

The December 2020 total local sales tax rate was also 6625. In fact rates in some areas are more than double the national average. For tax rates in other cities see New Jersey sales taxes by city and county.

Real estate evaluations are undertaken by the county. The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119. County Equalization Tables.

Jersey City was allocated 146 million in total ARP aid. The average effective property tax rate in New Jersey is 242 compared to. It was lower than the 2 percent cap former Gov.

POSSIBLE REASONS BEHIND STUDENT VISA REJECTION Read More. The General Tax Rate is used to calculate the tax assessed on a property. While Cape May County has the lowest property tax.

Ad Looking for Jersey City Tax Records. These portions have a 33125 sales tax rate. Homeowners in this Bergen County borough paid an average of 16904 in property taxes last year a 182 increase over 2018.

The New Jersey sales tax rate is currently. Did South Dakota v. Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future.

Jersey City establishes tax levies all within the states statutory rules. Click here for a map with more tax information. 252 551721 252 05 252 51 252.

The County sales tax rate is. I can confirm that 161 is correct but much like yourself was only finding 148 online. The 148 number is from 2018 and even Jersey Citys own website hasnt been updated to reflect the change.

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements. The minimum combined 2022 sales tax rate for Jersey City New Jersey is. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

The average 2021 property tax bill in Hudson County was 9009. The Average Effective Property Tax Rate in NJ is 274. You can print a 6625 sales tax table here.

Camden County has the highest property tax rate in NJ with an effective property tax rate of 391. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35. GMAT coaching in ChandigarhPunjab Read More.

Jersey city property tax rate 2020 Monday February 28 2022 Edit. Jersey city property tax rate 2020. Jersey City NJ Sales Tax Rate.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. NEW -- NJ Property Tax Calculator. On average the states property taxes rose 1 percent from 8953 to 9112 between 2019 and 2020.

The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119. The city of Jersey Village is looking to adopt a lower property tax rate for the 2020-21 fiscal year but one that will also raise more revenue. 53 million in 2020 and 89 million in 2021.

Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel. 2020-2022 Agendas Minutes and Ordinances. I am a member of the JCT education team.

The average tax rate was 4301. What is the Average Property Tax Rate in NJ. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Find New Jersey Tax Records Fast. Overview of New Jersey Taxes. There is no applicable county tax city tax or special tax.

The 6625 sales tax rate in Jersey City consists of 6625 New Jersey state sales tax. Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State.

It is equal to 10 per 1000 of the propertys taxable value. Visit Our Website Today. Jersey city property tax rate 2020 Read More.

Homeowners in New Jersey pay the highest property taxes of any state in the country. In 2020 and 2021 driven by the leadership of Superintendent Franklin Walker and under intense pressure from advocates with Jersey City Together the BOE raised the levy significantly. 78 million of that amount is included in the 2021 budget compared to 28 million of federal COVID-19 in 2020.

78 million of that amount is included in the 2021 budget compared to 28 million of federal COVID-19 in. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

Harris County Tx Property Tax Calculator Smartasset

This Is How Much Property Tax Relief You Ll See In New Nj Program Across New Jersey Nj Patch

Most Expensive U S Zip Codes In 2021 Propertyshark

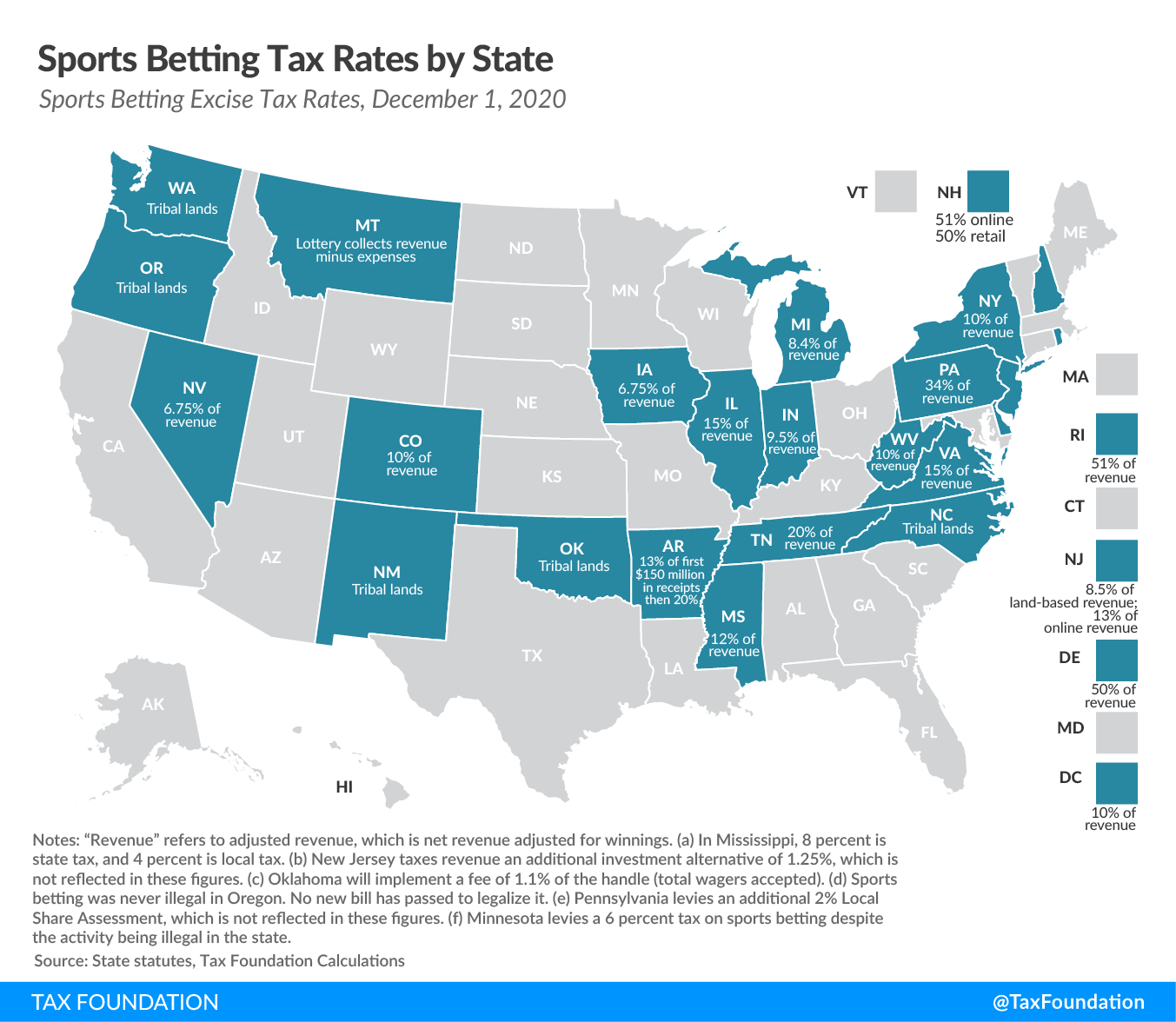

Internet Sales Taxes Tax Foundation

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

Internet Sales Taxes Tax Foundation

Lyndhurst New Jersey Nj 07071 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Jersey Retirement Tax Friendliness Smartasset

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

States With The Highest Property Taxes Gobankingrates

States With The Highest Property Taxes Gobankingrates

States With The Highest Property Taxes Gobankingrates

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

States With The Highest Property Taxes Gobankingrates

Lyndhurst New Jersey Nj 07071 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns